[ad_1]

Bitcoin’s large stock market place debut is coming at a lousy time.

3 of the world’s leading makers of cryptocurrency technological know-how are organizing to provide shares, providing buyers a new way to wager on electronic currencies. They’re reportedly hoping to increase billions of pounds.

Contrary to the greenback or the euro, which are issued by central banking institutions, cryptocurrencies are based mostly on laptop code. Bitcoin, for example, is established and traded by the “mining” method in which computer algorithms remedy more and more complicated math problems.

Bitmain, Canaan and Ebang, which are all centered in China, make funds by selling the substantial-tech components and techniques that ability this mining. Collectively, they dominate the business.

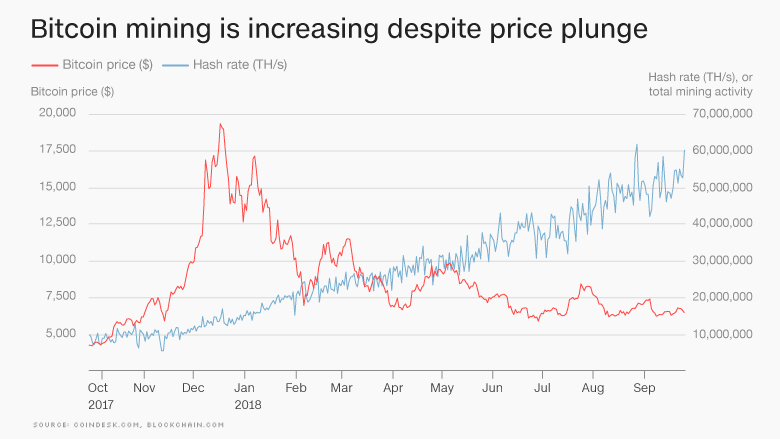

But the 3 organizations operate in a younger, unpredictable sector and are preparing their IPOs in Hong Kong in brutal sector problems. The cost of bitcoin, which soared to approximately $20,000 in December, has since plunged by about two-thirds. Other cryptocurrencies like ethereum have plummeted, much too.

“If the market place price of cryptocurrencies suddenly falls … desire for our mining components and cryptocurrency mining products and services will also drop rapidly,” Bitmain warned likely investors this week.

On best of that, Hong Kong’s stock market place, in which the firms program to listing, entered a bear industry this month, owning plunged extra than 20% from its earlier peak due to the fact of problems about China’s financial slowdown and trade war with the United States.

The mining technological innovation firms have not explained when accurately they approach to go public or how considerably they’re seeking to elevate. Bitmain and Canaan declined job interview requests, whilst Ebang did not reply to a ask for.

“These companies may possibly be seeking to money out before the current market normally takes an even steeper nosedive,” explained Benjamin Quinlan, founder of Hong Kong-centered fiscal services consulting agency Quinlan & Associates.

He details out that cryptocurrencies are slowly and gradually getting much more acceptance amongst mainstream buyers inspite of recent setbacks, and that the a few mining companies’ revenues are however rising. But the sector faces key worries.

A crucial a single is how governments go about regulating digital currencies. Very last yr, China banned most actions involving bitcoin. The place is even now imagined to be dwelling to a considerable amount of cryptocurrency mining operations, but authorities have been striving to thrust them out.

Cryptocurrency miners have to have massive amounts of electrical energy to operate their rooms complete of computing gear all-around the clock. Some community utilities in the United States are now introducing greater tariffs particularly for miners.

“Increasing the cost of bitcoin mining will reduce the need for mining products, hindering the effectiveness of these corporations,” Quinlan mentioned.

Mining cryptocurrencies is already less profitable than it applied to be.

Bitcoin mining activity has exploded about the previous yr, boosting need for the technological know-how. But that usually means the revenue from mining are distribute more thinly across a increased variety of buyers. That could strike upcoming desire for mining machines.

Will the mining boom very last?

Bitmain, Canaan and Ebang have been all financially rewarding in their most modern economic yr, in accordance to files location out their intention to go general public.

But staying in the black will be a “substantial challenge,” claimed Leilei Wang, a Shanghai-based marketing consultant at study company Kapronasia.

The providers are mindful of the threats they encounter and are striving to adapt. For instance, they say they are raising investment in more innovative chip know-how that can be applied in spots like synthetic intelligence, cybersecurity and connected gadgets.

Although the Chinese governing administration has a difficult stance on cryptocurrencies in general, it can be keen to bulk up the country’s technological prowess in locations like laptop or computer chips. Chinese companies are continue to mostly reliant on overseas chip technologies, specially from the United States.

“No matter whether [the cryptocurrency companies] are in a position to effectively pivot continues to be to be noticed,” Wang said.

For now, their fate is tied to that of the broader industry.

“Cryptocurrencies will most likely slide out of favor” devoid of larger mainstream adoption in the near future, Quinlan predicted. The mining gear makers “will uncover it extremely tough to survive when the cryptocurrency market, as a complete, withers away,” he said.

But bitcoin bulls are continue to hopeful that the currency can stage a recovery as monetary exchanges and large corporations start to take it much more seriously.

“As you see more adoption of just folks currently being cozy with it, it feels like it’s heading to go up,” Mike Novogratz, CEO of cryptocurrency investment agency Galaxy Electronic, advised CNN this week.

CNNMoney (Hong Kong) Initially published September 27, 2018: 6:56 AM ET

[ad_2]

Supply connection